Oftentimes nonprofit organizations become set in their fundraising ways, focusing only on a couple of revenue streams that have worked in the past. Whether it’s honing in on only a handful of donors or relying heavily on a single grant each year, nonprofit organizations can get a bit inflexible in how they choose to raise funds. However, the reality is, diversifying your fundraising strategy is critical to the livelihood and longevity of your nonprofit. If your approach to fundraising is feeling a bit dated or slimmed down, keep reading!

The ways in which you raise money can be called your “fundraising buckets.” And while the blueprint to fundraising comes in many shapes and sizes, it’s important that your nonprofit uses a wide variety of fundraising buckets. When you diversify your fundraising strategy, you protect your nonprofit from becoming too siloed financially.

What are some ways to diversify your fundraising strategy? Fundraising buckets that your nonprofit should adopt are explained below –

#1 Individual Giving

Individual giving is the most commonly used fundraising bucket and relates to gifts coming directly from individual donors, in the form of cash. Individual giving can present in a number of ways. Individual gifts can be recurring gifts, in which a donor gives a set amount at a specific interval. Individual gifts can be given in the form of a pledge. A pledge is where a donor pledges a certain amount of money, to be given to your organization by a specific date. And finally, individual giving can come in the form of major gifts. Major gifts are large gifts (the definition of large will vary across organizations), in which a donor pays the amount upfront and in full, usually once a year. Major gifts are usually collected through a major gifts program, to learn more about launching a major gifts program, read here.

#2 Legacy Giving

Legacy giving refers to giving after death, authorized via someone’s will or last testament. Legacy giving is often referred to as ‘planned giving’ because nonprofits plan the gift(s) with the individual before their passing. It may sound morbid or off-limits, but the reality is that many donors leave large sums of money to nonprofits upon their passing. Many nonprofits never explore legacy giving because it can be a difficult fundraising strategy to navigate, but the reality is – it can provide hefty donations and is worth exploring.

#3 In-Kind Giving

In-Kind giving refers to donations made to your nonprofit that are not in the form of cash. In other words, they are goods or services provided, at no cost to your organization. In-kind gifts could look like free haircuts for the homeless or food for a family in need. They could also take the form of a wealthy donor giving a plot of land for free, or donating their boat directly to your organization. Accepting in-kind gifts provides your organization with a unique fundraising strategy opportunity because it gives donors, especially small businesses, an opportunity to engage in a charitable endeavor without feeling pressured to write a large check. And what’s more – it helps you develop deeper connections to other businesses in your community.

#4 Grants

Nonprofit grants are financial donations made to an organization, usually by corporations, for-profit businesses, or the government. And while grants never need to be repaid, there is usually the expectation that your nonprofit will provide data, reports, and/or feedback about where and how you spent the money. Because grants are generally larger in size, they become an invaluable resource to many nonprofits, and oftentimes sustain a nonprofit across an entire year. There are thousands upon thousands of grants being offered to nonprofits within the US and abroad. If your organization is not currently applying for grants, it is the perfect fundraising bucket to start exploring! Need help getting started with grant applications? Check out Eleo’s Consultant Community to find a grant expert that fits your needs.

#5 Donor Advised Funds

A donor advised fund is an investment account used specifically to eventually make charitable donations. The monies are taxed upon donating to the DAF, rather than when they are given to a charity. Because donor advised funds provide many benefits to donors, their popularity has skyrocketed. That said, in order for a nonprofit to benefit from them, they need to be accessed. 37% of DAF accounts can go unused in a given year.

In 2024, the first-ever DAF Day was celebrated as a giving day dedicated to donor-advised funds. DAF Day was launched to raise awareness, address misperceptions, and expand usage of DAFs. In other words, donor advised funds are the place to be. It’s important your nonprofit explores where your donations are coming from. If you have a donor giving from a DAF, cultivating a deeper relationship with them should be top priority!

CONCLUSION:

There are many ways to diversify your fundraising strategy. As your nonprofit begins to explore how you can add to your revenue streams or fundraising buckets, the five arenas listed above should be top priority! Whether it’s individual giving, government grants, or donor advised funds, there are mainstream, established donation avenues that you can tap into swiftly and effectively.

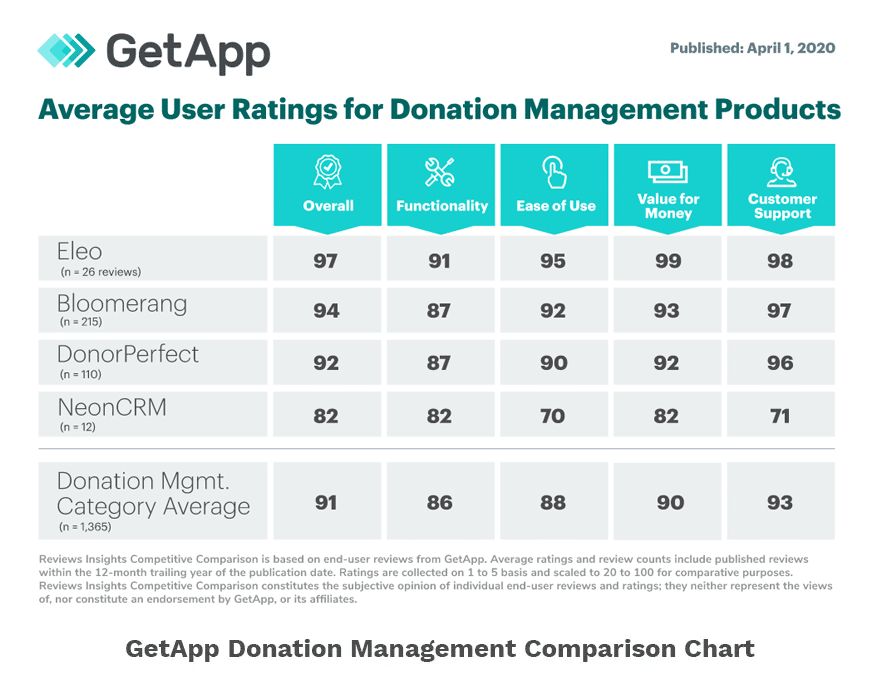

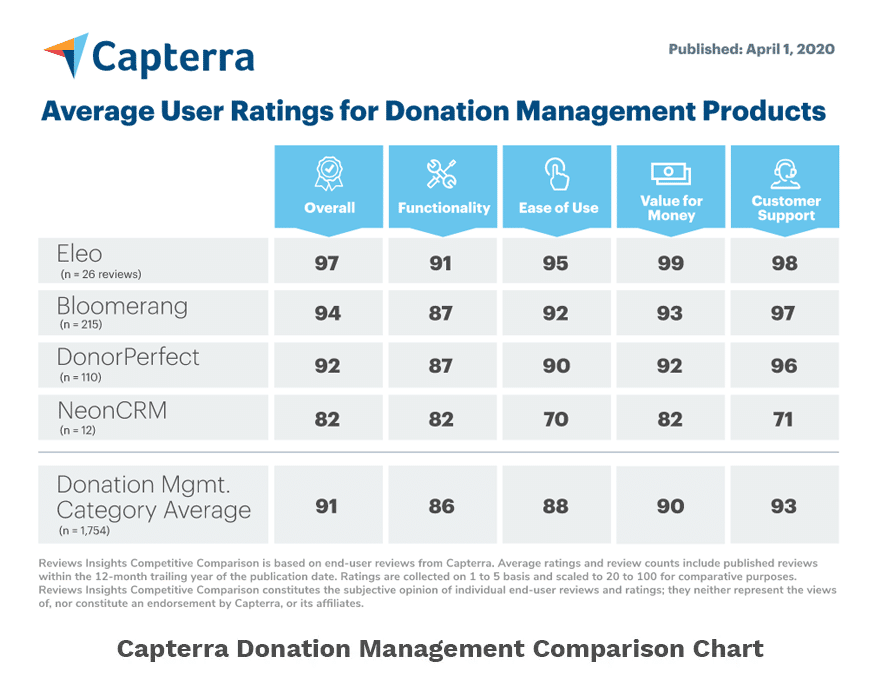

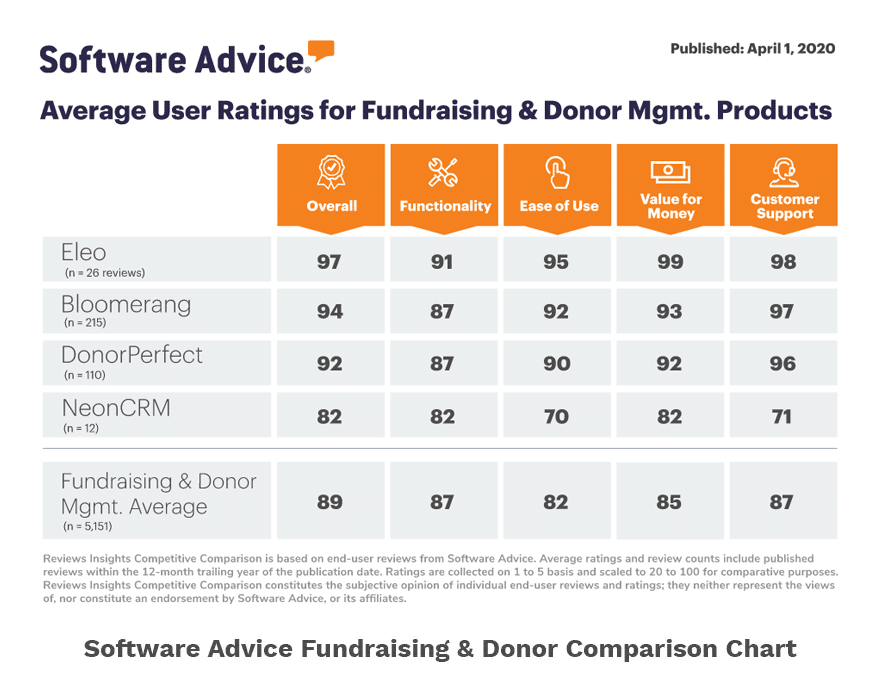

Need help organizing all of your fundraising buckets? Check out how Eleo Donor Management will help you stay organized and streamlined.